MOB Quarterly Update: Decade-Low Transaction Volume of $1.4B in Q1-2024

As macro-economic factors stall transaction activity and limit supply, less price-sensitive sellers enter the market.

Introduction

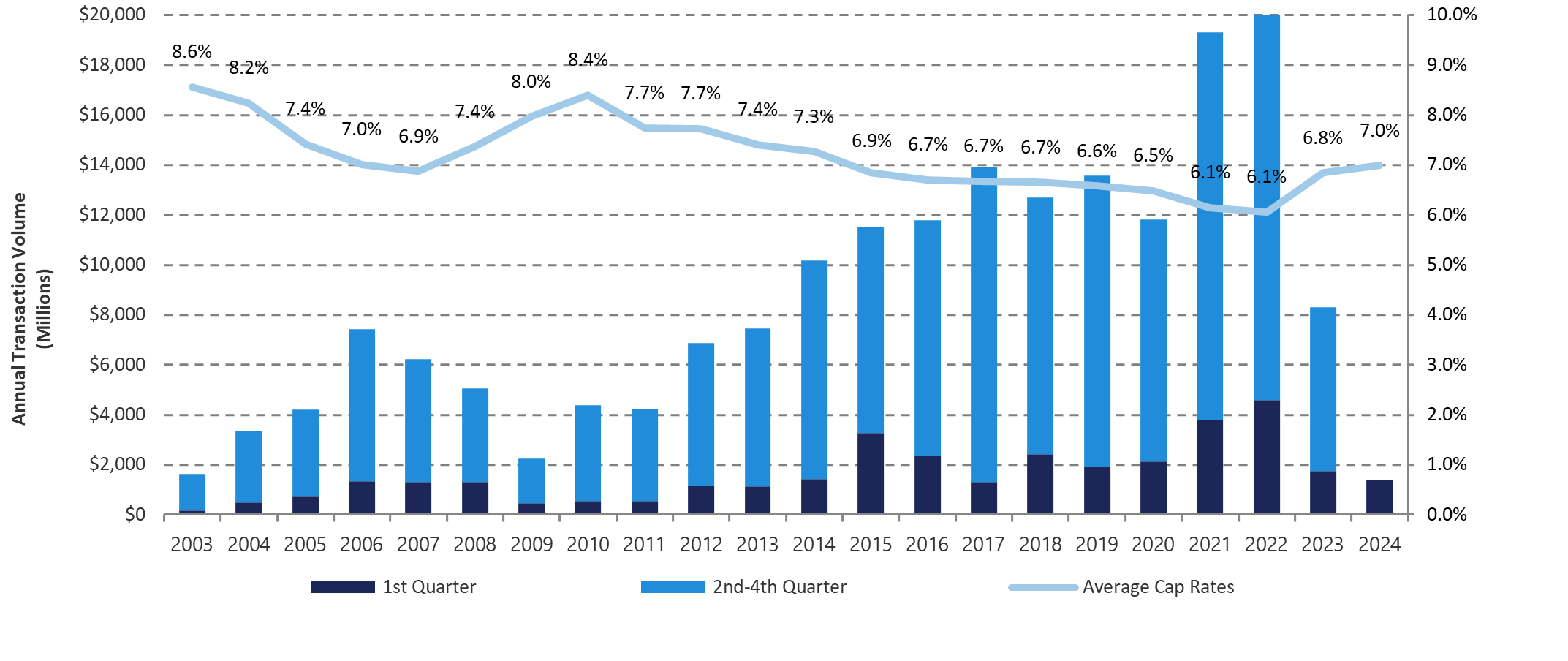

In the first quarter of 2024, the transaction volume for medical outpatient buildings (“MOBs”) amounted to $1.4 billion, marking the lowest quarterly volume in the sector since 2014. This figure represents a significant 20.7-percent decline from the same quarter in 2023. However, the decline becomes even more pronounced when considering the trailing-12 months sales volume of $7.9 billion; a staggering 55-percent decrease from the same quarter in 2023. Additionally, the first quarter saw only 214 MOBs transact, marking the lowest number of buildings traded during the first quarter since 2014.

Source: Based on an FTS analysis of industry data from Real Capital Analytics.

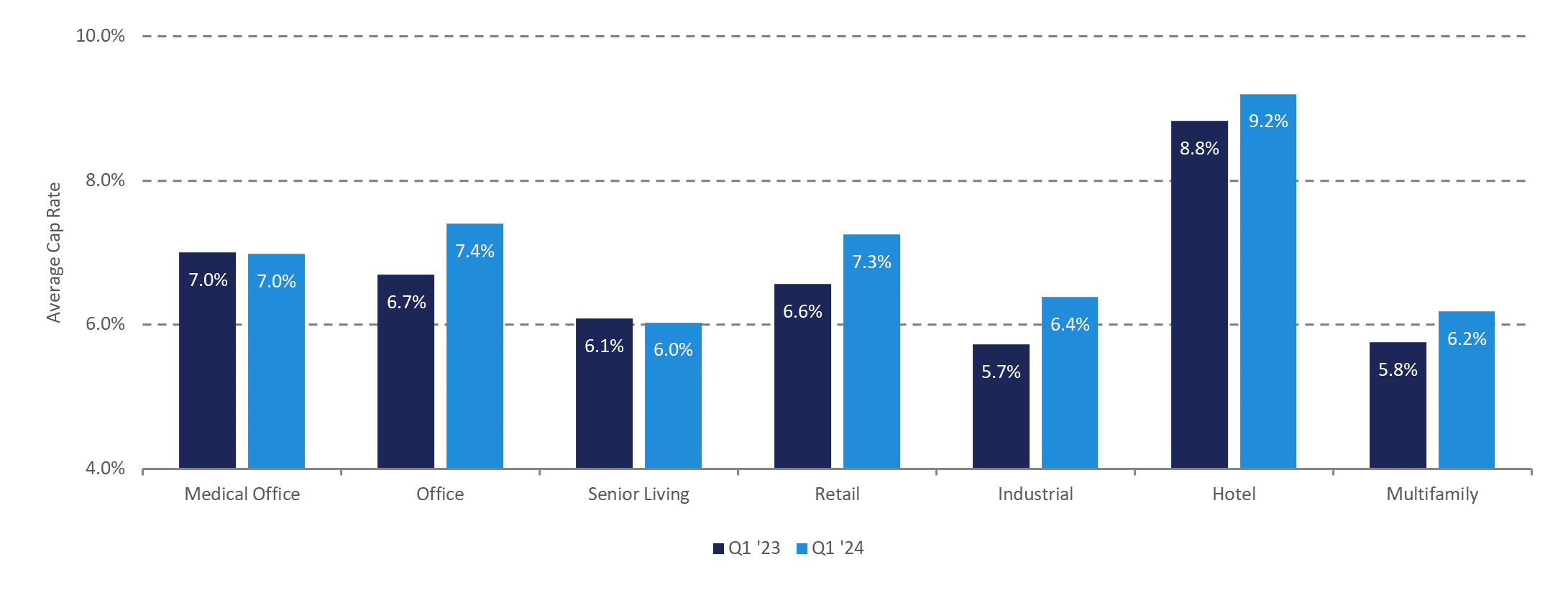

Despite holding steady throughout the previous two quarters, cap rates ticked upwards over the first three months of 2024 reaching 7.0-percent, the same quarterly average seen in the first quarter of 2023. As most other asset classes saw an increase in average cap rates year-over-year, medical outpatient buildings stabilized valuation metrics further highlight the strength of the asset’s underlying fundamentals. Steady cap rates coupled with decreased sales volume indicate that the sector’s reduced transaction activity can be primarily attributed to the stubborn state of debt capital markets.

Source: Based on an FTS analysis of industry data from Real Capital Analytics, Costar and US Bureau of Labor Statistics.

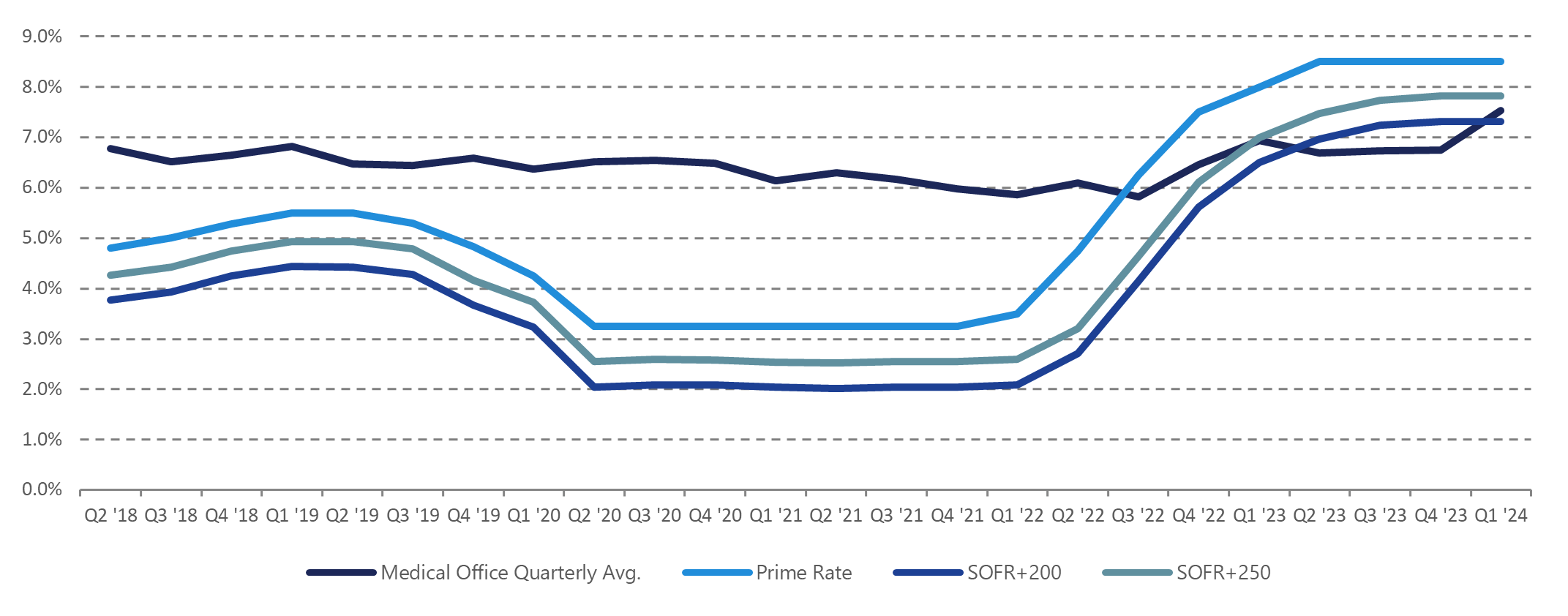

Transaction volume has now decreased for the sixth straight quarter since it reached a peak of $23 billion in the third quarter of 2022. This steady decline can be attributed to consistent rate hikes by the Federal Reserve (“The Fed”) that began at the end of the first quarter in 2023. The high interest rate environment during this time period has caused a misalignment in in buyer valuations and seller expectations as interest rates sit substantially above where they did when most MOBs were acquired over the last seven-to-ten years, creating a widening bid-ask spread as the increasing cost of debt has left price sensitive buyers unable to attain adequate financing needed to meet sellers’ guidance. As expensive debt has resulted in a widening bid-ask spread, an imbalance of high demand and low supply has entered the market thereby creating an opportunity for less price-sensitive sellers such as health systems to effectively monetize their real assets to improve their balance sheet health and bolster their liquidity positions helping to mitigate the effects of increased labor and operating costs.

As stated in our most recent report, future rate cuts continue to remain uncertain leaving many prospective investors on the sideline until further clarity is provided as to when the Fed will begin to implement rate cuts. Despite inflation easing over the past year, the U.S. economy added over 100,000 more jobs than predicted in the month of March while wages sat 4.1-percent higher than the same time a year ago. Many economists predicted early 2024 rate cuts, however, due to a resilient labor market many are predicting rates to remain steady until late into 2024 with some suggesting we will not see an initial cut until the first quarter of 2025.

Despite an uncertain capital market’s environment, medical outpatient buildings continue to remain an attractive investment opportunity with respect to their operations, offering an economically resilient product, long-term verifiable income streams and sticky, creditworthy tenants. As valuations remain resilient, but debt remains expensive health systems and providers’ real estate activity has picked up, as healthcare providers now make up nearly-10 percent of transaction volume as sellers, which is double historical average [<5.0 percent] in comparison to prior years. We expect to continue to see this trend of a less price-sensitive sellers in the market like health systems and providers, who are balance-sheet driven, to capitalize on the imbalance of supply and demand in the market today and represent a larger portion of sellers that they historically have.

Investment Sales Trends

Source: Based on an FTS analysis of industry data from Real Capital Analytics.

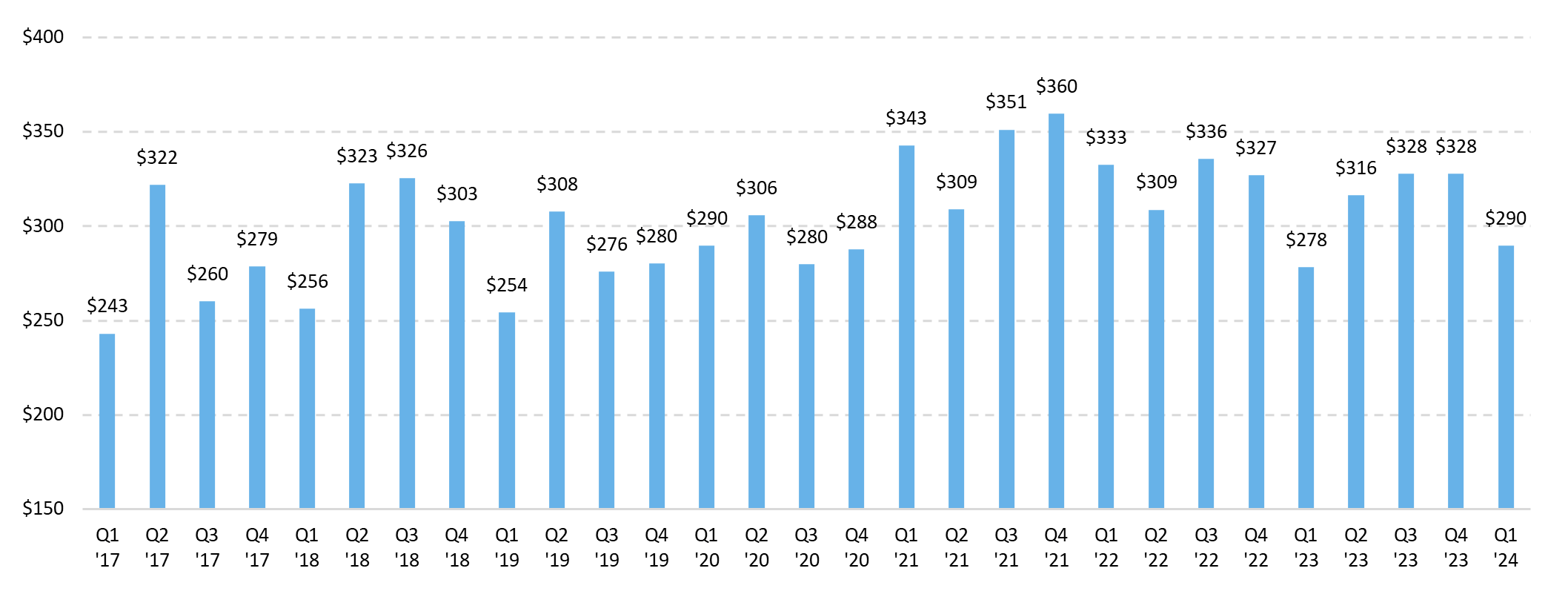

The average price per square foot for the first quarter equated to $290/SF. This figure represents almost a 12% decline compared to the previous two quarters. However, while declining compared to the last two quarters, the metric sits about 4% higher compared to the first quarter in 2023, further illustrating resilient valuations year-over year.

The largest single-asset transaction occurred in January when Hammes Partners acquired the 160,000-square foot Hudson Medical Center located in Hudson, WI for $72.0 million. The multi-tenanted property was built in 2023 and features an orthopedic field house and ambulatory surgery center. The seller, Hudson Medical LLC, developed the state-of-the-art healthcare facility to house specialty services that include primary care, imaging, orthopedics, ophthalmology and oncology. Tenants at the three-story building include Minnesota Oncology, Twin Cities Orthopedics, Valley Surgery Center and Associated Eye Care.

The largest portfolio to transact in the first quarter closed at the end of March as Kayne Anderson and JV partner Remedy Medical Properties acquired a 37-asset portfolio from Broadstone Net Lease for $252 million. The portfolio spans 13 states and amounts to 708,000-SF. The portfolio comprises a range of healthcare facilities including ambulatory surgery centers, surgical hospitals, and imaging centers among others. Each of the 37 properties are 100-percent leased to best in-class health systems including Advocate (Aa3/AA/AA)1, IU Health (Aa2/AA/AA)1, Tampa General (Baa1/A-/A)1 and TGH imaging.

Source: Based on an FTS analysis of industry data from Real Capital Analytics and Chatham Financial

Regional Review

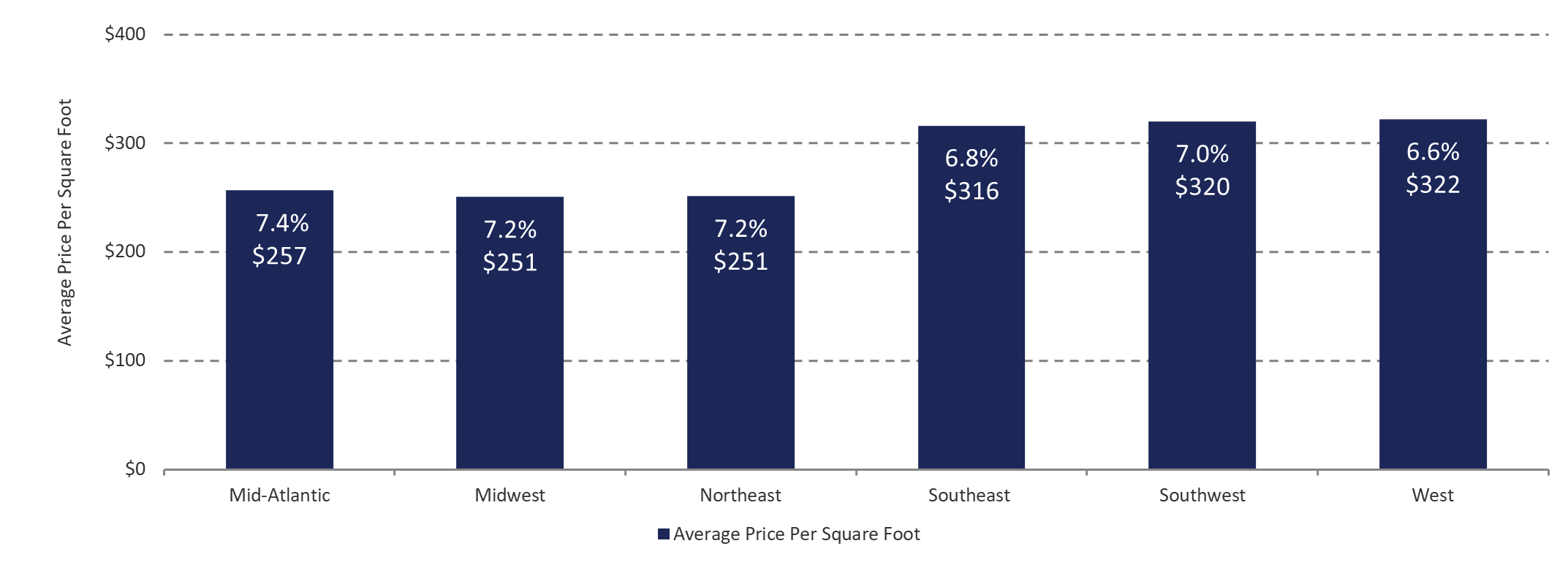

Despite a lackluster quarter with respect to transaction volume nationwide, the Midwest benefited from favorable demographic trends as the region outperformed its most recent quarter boasting $407 million in transaction volume—their best performing quarter since 2022. Additionally, the spread in cap rates among all regions tightened from 170-basis points last quarter to just 80-basis points with the West Region realizing the lowest quarterly average cap rate of 6.6-percent and the Mid-Atlantic experiencing the highest at 7.4-percent.

Source: Based on an FTS analysis of industry data from Real Capital Analytics

Northeast Region

In March, a joint venture between Sendero Capital and TPG Angelo Gordon acquired a 30,000-square foot, Class B MOB property in Warwick, RI for $8.1 million. The building, which was constructed in 1998, was sold through a partial sale/leaseback by NeuroHealth. The three-story property is anchored by NeuroHealth, who occupies 40.0-percent of the building. Other tenants include Rhode Island Medical Imaging and Care New England/Kent Hospital (-/B+/BB-)1. The building was 100-percent occupied at the time of the sale. Located 10 miles from downtown Providence, the property is strategically located between interstates 95 and 295.

In January, NYU Langone Health (A1/A+/-)1 opened a 260,000-square foot facility in Garden City, NY. The property, a former Sears retail building, underwent a $170 million renovation, highlighting a recent trend by health systems who are attempting to take advantage of converting vacant big box retail into state-of-the-art health care facilities. The redeveloped property is now home to an ambulatory care center and 32 medical practice groups that include cardiology, radiology and pediatrics. The MOB is located less than a mile from NYU Langone Hospital—Long Island which boasts 591 beds.

Mid-Atlantic Region

In February, Nashville-based Montecito Medical expanded their Mid-Atlantic presence by acquiring a 35,000-square foot MOB in Richmond, VA for $16.6 million. The two-story building, which is located less than 16 miles from downtown Richmond, is fully occupied under a long-term lease by Virginia Women’s Center (“VWC”), a women’s health services provider headquartered in Richmond. VWC offers services at the building that include gynecology, obstetrics, urogynecology, breast health/mammography, menopause management, mental health, weight and wellness, bone health/density, as well as surgeries and procedures. With this acquisition, Montecito now owns eight medical outpatient facilities within the Richmond MSA.

In March, Highwoods Properties completed the sale of a 338,000-square foot, eight building portfolio located in Raleigh, NC for $79.4 million. The portfolio was sold to two buyers with Denver-based Evergreen Medical Properties acquiring seven of the eight buildings. All seven of the buildings that Evergreen purchased were located in the Rexwoods Office Center campus in West Raleigh. Charlotte-based Northwood Ravin acquired the eighth property which is located adjacent to the Research Triangle Park and ultimately has plans to redevelop the property.

West Region

In February, Clark County purchased a 20,833-SF medical outpatient and behavioral health facility in Las Vegas, NV for $10.4 million. The county will partner with University Medical Center to provide crisis stabilization and high-need services to patients experiencing a behavioral health crisis. The addition of this facility will benefit the community of Clark County as it will address the need for behavioral health services in the area, thereby taking pressure off the local emergency rooms who experience a daily influx of mental health patients.

IRA Capital, an Irvine, CA-based private equity firm, purchased a 21,900-square foot MOB in Folsom, CA for $7.35 million. The property, which was developed in 2006, is 100-percent occupied by Dignity Health (A3/A-/-)1. Dignity offers services that include cardiology, imaging, endocrinology, gastroenterology, general surgery, OB-GYN, oncology and urology among others. Dignity Health’s lease, which commenced in 2022, is set to expire in 2027.

Southwest Region

In February, Madison Marquette sold a 54,941-square foot MOB in Irving, TX, to the Irving Hospital Authority. Completed in 2018, the Class A, three-story building was 68-percent occupied by five tenants during the time of the sale. The property, which is adjacent to the 296-bed Baylor Scott & White Hospital, is anchored by Texas Health Resources (Aa2/AA/-)1 who occupies 22-percent of the building. Other tenants include Pure Dermatology Associates, Arlington Orthopedic Associates, Touchstone Medical Imaging and Dallas Nephrology Associates. Ideally situated off U.S. Route 183, the building is 13 miles from downtown Dallas and in an area dominated by medical facilities.

Also in February, Houston Methodist (-/AA/-)1 purchased a 32,869-square foot newly developed MOB for $14.0 million. Located in Creekside Park, TX, the two-story building, which was delivered in shell condition, was developed in 2023. Houston Methodist has plans to open a multi-specialty clinic with as many as 10 different providers, including five primary care services, orthopedic services, and likely both physical and occupational therapy practices.

In March, Cypress West completed the sale of a 30,471-square-foot MOB in Mesa, AZ, to NewStreet Properties for $15.4 million. Acquired vacant in 2023, Cypress West invested over $3.0 million in capital improvements, successfully leasing the property to Cardiovascular Associates of Mesa. The upgrades included a modernization of the 10,000-square-foot ambulatory surgery center, bringing it up to licensure standards and code. This renovation provided two operating rooms, with the potential to expand to four.

Midwest Region

In January, Chicago-based Remedy Medical Properties acquired a six-building, 145,308-square foot MOB portfolio in Northern Kentucky for $43.25 million. The portfolio includes a 50,000-square foot muti-specialty practice medical outpatient building in Florence, a 45,000-square foot primary care and family medicine center in Fort Mitchell, a 19,500-square foot urgent care in Critten, a 13,063-sqaure foot primary care center in Walton, and two smaller family practice properties located in Alexandria and Butler. All six properties are leased to St. Elizabeth Physicians, a multi-specialty physician organization of St. Elizabeth Healthcare(-/AA/AA)1 with practices in Kentucky, Ohio, and Indiana totaling 169 offices in the tri-state area.

The Dallas-based Landes Group acquired The University Hospitals Wellness Campus located in Mentor, OH in February. The 85,977-square foot MOB was purchased from the Lake County Economic Development Authority which developed the property in 2017. The two-story, Class A outpatient clinic provides a variety of services, including physical therapy, sports medicine, urgent care, primary care, integrative medicine, cardiology, pain management, orthopedics, imaging and a clinical laboratory. Lake Health, who is a part of the University Hospitals Health Systems (A2/A/-)1, occupies the entire facility.

Also in February, Montecito Medical acquired a two-building, 92,573-square foot medical center for $30.8 million. Located in Germantown, WI, the facility is 100-percent occupied by Aurora Health Care Inc, a subsidiary of Advocate Health (Aa3/AA/AA)1. The medical center is inclusive of a 76,585-square foot building which was converted for medical use in 2016 and houses a surgery center with six operating rooms, 16 oncology infusion bays, exam rooms and a healing garden for cancer patients. The second building, a 15,998-square foot facility, offers medical services such as chiropractic care, family medicine, gastroenterology, pain management, pediatric cardiology, and sport rehabilitation.

Southeast Region

In January, Davis Healthcare Realty Investors purchased a 24,465-SF medical outpatient facility in Zachary, Louisiana for $8.6 million. The single-story facility was developed in 2011 and is 100-percent occupied by three tenants—Zachary Surgical Center, Moreau Physical Therapy and Ochsner Health (A3/A/-)1, a prominent Louisiana health system with over 40 locations throughout the state. Boasting a synergistic tenant roster, the facility offers medical services including orthopedics, gastroenterology, podiatry, physical therapy and primary care services.

NYU Langone (A1/A+/-)1 will expand their presence in Florida with the purchase of a building in West Palm Beach for $33.0 million. The acquisition will mark the third location in West Palm Beach for NYU and the fourth within Florida. The 181,492-square foot building will house multiple specialties including physical therapy and gynecological care. NYU Langone has increased their footprint within the Sunshine State as they continue to see a persistent flow of patients migrating from the Northeast. The property is located less than a mile from their office at 101 N. Clematis St., which opened in 2017.

In February, North Broward Hospital purchased a 37,000-square foot medical outpatient property for $11.0 million. The building is located across the street from Broward Health Coral Springs, a 250-bed hospital that offers a full continuum of care, and a specialized ER for kids. The five-story building was constructed in 1978 and North Broward has plans on occupying the entire property.

To learn more about healthcare investment banking and real estate investment banking solutions, contact Philip J. Camp, Managing Director, Real Estate Investment Banking Group, at pj.camp@53.com or Matthew T. Tarpley, Managing Director, Real Estate Investment Banking Group, at matthew.tarpley@53.com.