MOB Quarterly Update: Sales Remains Low, But Signs of Optimism are Emerging in Q2-2024

Amid potential September rate cuts, investors are beginning to show signs of optimism as first half sales increase.

Introduction

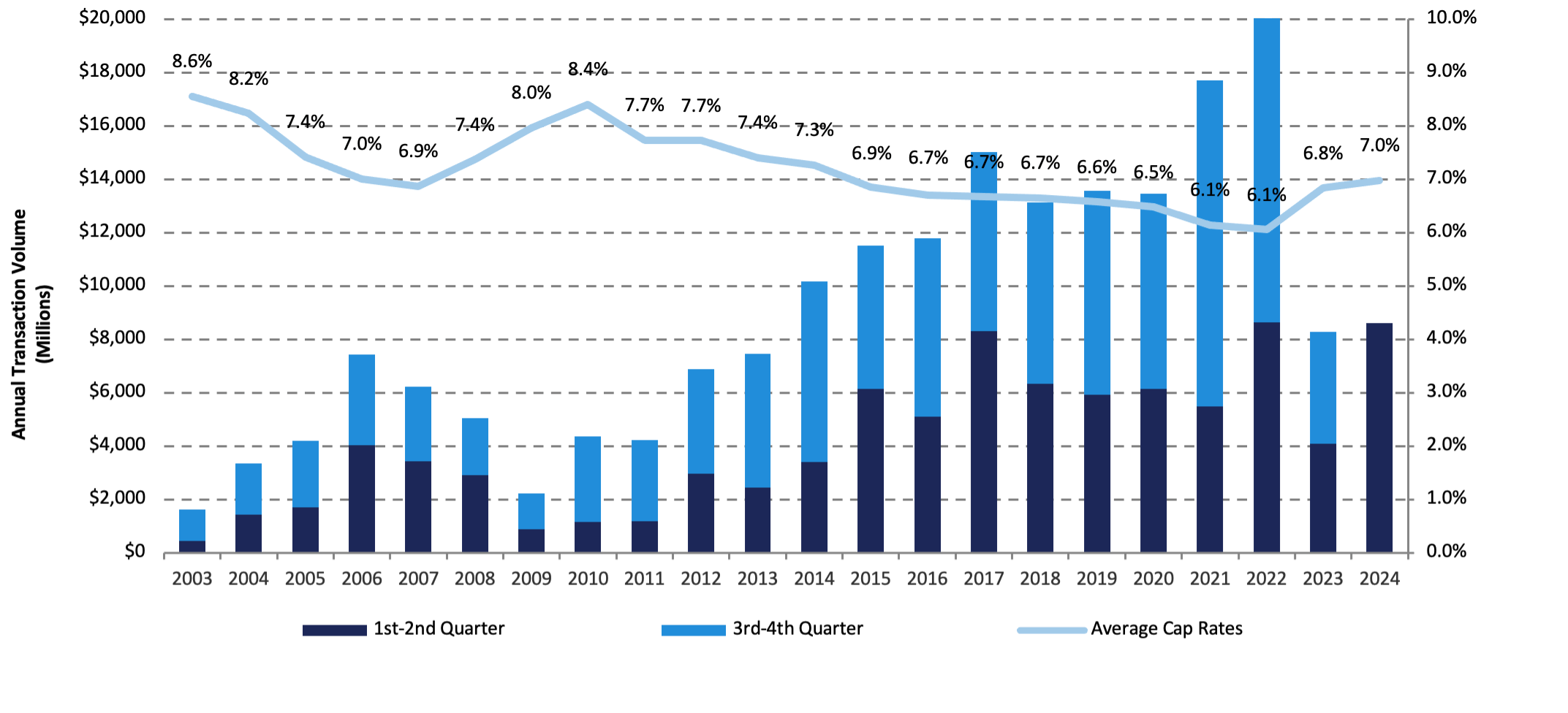

Medical outpatient building ("MOB") sales volume in the second quarter amounted to $2.3 billion, bringing the total for the first half of 2024 to $8.6 billion, the highest sales volume for the first half of a year since a record 2022. The total sales of $6.3 billion in the first quarter is a revision of the previously reported $1.4 billion in our first quarter report, that only included property-level transactions, as the $4.9-billion-dollar increase reflects the DOC REIT acquisition wherein 329 outpatient buildings transacted. Excluding the REIT acquisition, sales volume increased quarter-over-quarter by over 60-percent, indicating that the sector is starting to see increased optimism from investors within the MOB market.

Source: Based on an FTS analysis of industry data from Real Capital Analytics.

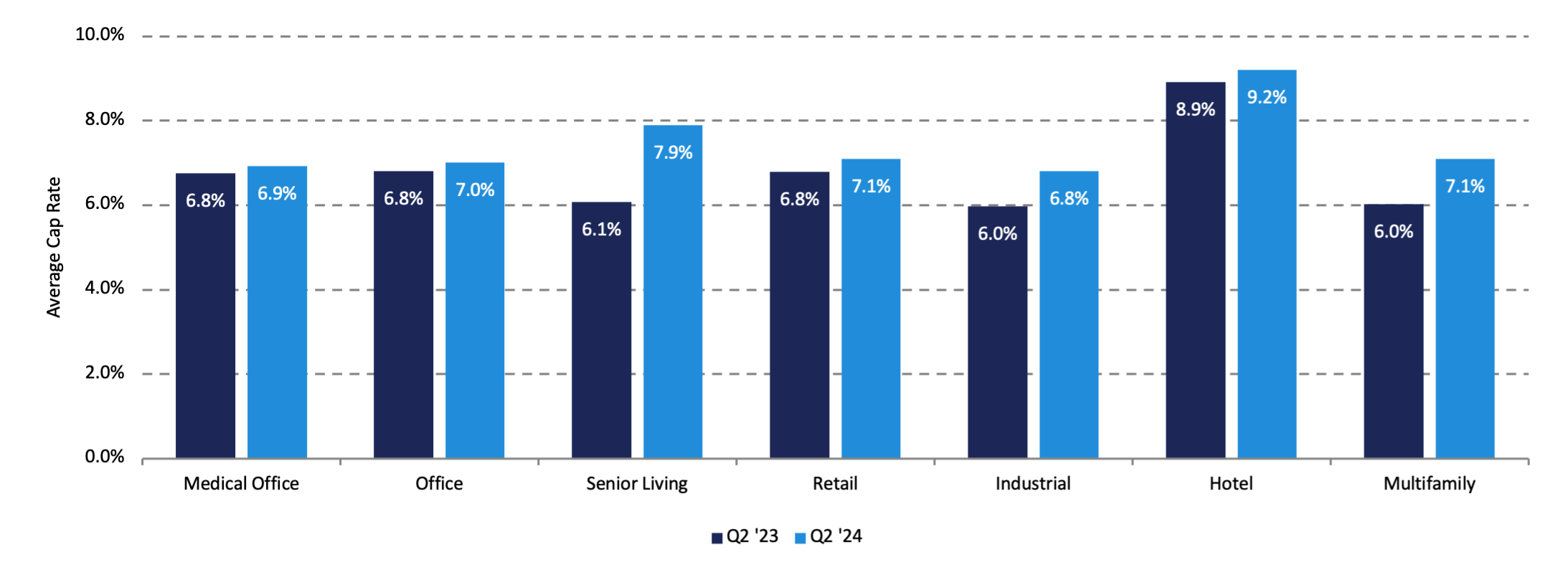

Cap rates also reflected that investor optimism is beginning to improve as the average cap rate among medical outpatient building transactions in the second quarter was 6.9-percent, a decrease of 10 basis points from the previous quarter. Cap rate data also suggests that the underlying fundamentals of the healthcare real estate sector remain resilient compared to those of other asset classes. Medical outpatient buildings experienced the smallest spread (10 basis points) between cap rates today and those of a year ago compared to the primary general real estate asset classes.

Source: Based on an FTS analysis of industry data from Real Capital Analytics and Costar

Recent data from MCSI suggests that investor sentiment in the sector is slowly improving. Investors are starting to factor potential rate cuts into their investment analysis and are gradually beginning to deploy more capital that had previously been sidelined as they anticipate rate reductions in September. Despite strong fundamentals and sufficient demand for healthcare services, in the short term, investors are expected to remain prudent and conservative when underwriting potential investments until an improved capital markets environment is realized.

Factors such as a rapidly increasing senior population that is expected to grow by over 50-percent in the next ten years, inflated construction and capital costs that have limited the supply of new product in the market and a shift to outpatient facilities as a preferred care setting have created a substantial supply and demand imbalance within the market, illustrating that any dip in transaction volume over the past year and a half has been primarily a result of punitive macro-economic factors contributing to an increased level of investments not penciling for investors, rather than industry-specific factors.

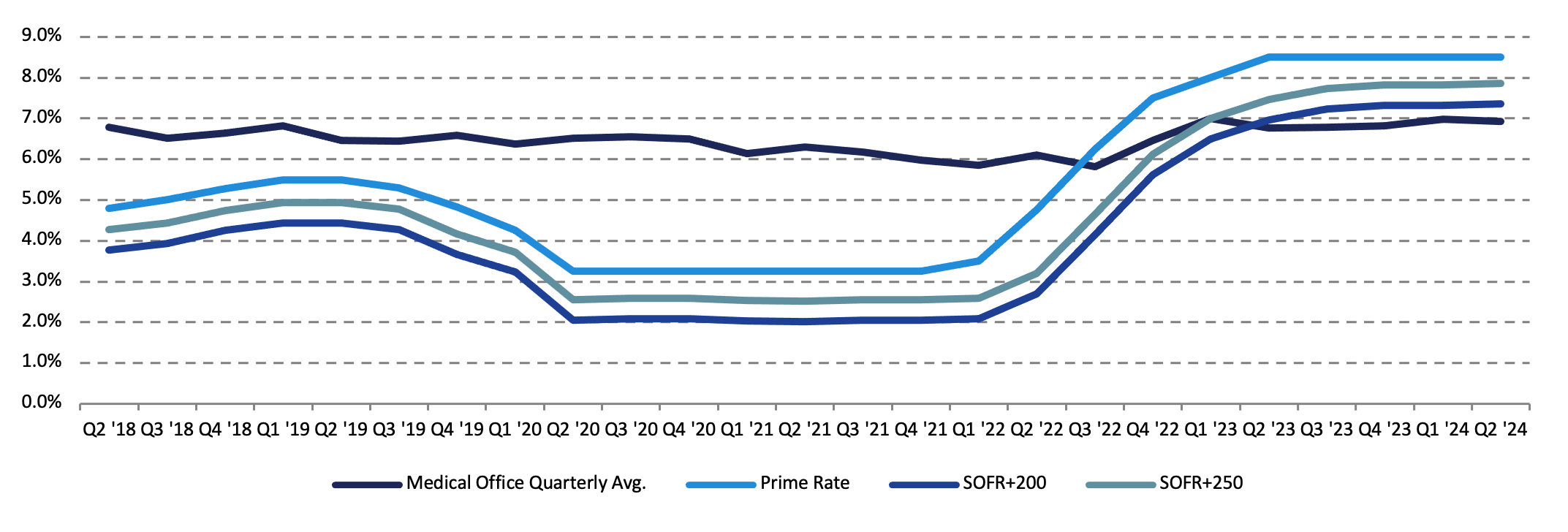

The Federal Reserve ("Fed") has held the federal funds target rate steady at 5.25-percent to 5.50-percent since the second quarter of 2023, suggesting that we have reached the apex of the interest rate cycle, leaving industry players to question when we will begin to see rates come back down and spark further investor activity. Two factors that largely contribute to the Fed’s decisions with respect to monetary policy are inflation and unemployment figures. As of July 31st, inflation sits just half a percent above the Fed’s target of 2-percent, meanwhile unemployment rose to 4.3-percent, the highest since October 2021, indicating that it is time to ease monetary policy and begin to implement rate cuts. The Fed’s next meeting is in September when many economists believe that we will see rates decreased for the first time since the first quarter in 2020. As demand remains high for the economically resilient product, once interest rates begin to be reduced beyond the expected initial reduction in September, we expect to see increased transaction volume among the medical outpatient sector as a lower cost of capital will foster investment activity and investors will look to capture the unmet demand in the market.

Investment Sales Trends

Source: Based on an FTS analysis of industry data from Real Capital Analytics.

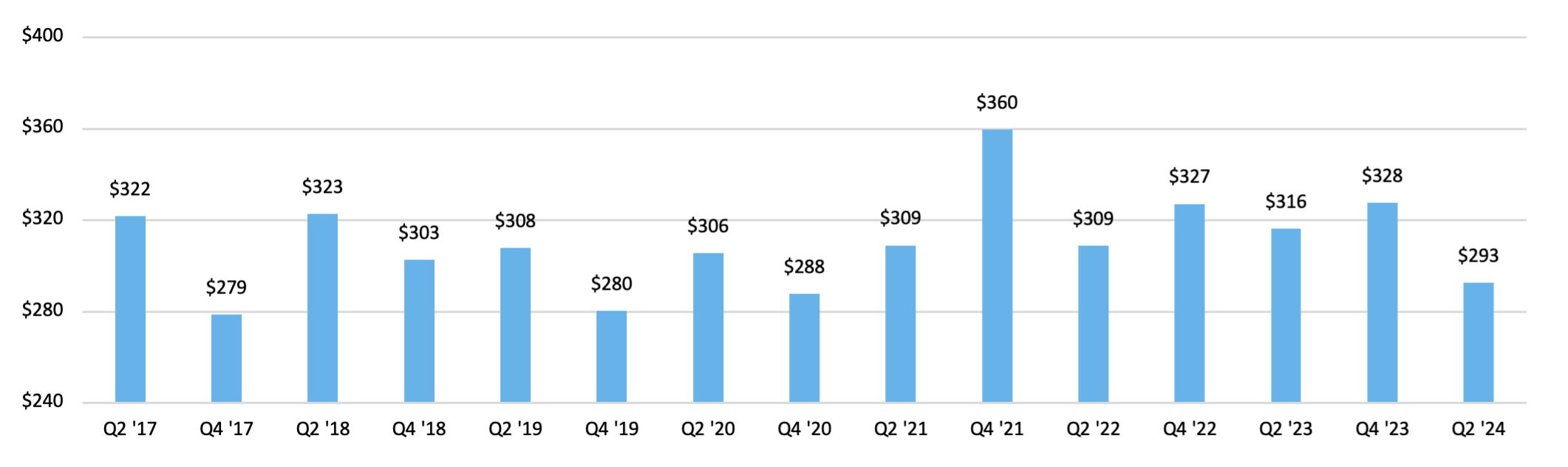

The average price per square foot for MOB sales in the second quarter rose 1-percent from the previous quarter to $293/square foot. While a minimal increase, this marks the first period since the third quarter of 2023 that price per square foot has increased and further illustrates the market is slowly beginning to move in the right direction and valuations will continue to improve as monetary policy eases and investors are provided increased access to cheaper capital.

The largest single-asset transaction occurred in June when Welltower (NYSE: WELL) acquired a 103,652-square foot medical outpatient building from Heitman for $45.6 million or $440/square foot. The outpatient facility, which is located in Sacramento, CA, was 88-percent leased at the time of sale to Sutter Health(-/-/A+)1 offering family medicine, internal medicine, physical therapy, surgical and urgent care services. The facility, built in 1990 and renovated in 2013, includes a six-story parking structure, on-site laboratory, infusion clinic and ambulatory surgery center comprising three operating rooms and offering orthopedic, spine, neuroscience, podiatry and rheumatology surgeries.

The largest portfolio transaction of the second quarter was completed in late June when, North Palm Beach-based AW Property Co. acquired a nine-property, 309,424-square foot medical outpatient portfolio from Healthcare Realty Trust (NYSE: HR) for $99.5 million or $321/square foot. The entire portfolio is located throughout North Carolina with the Church Street Medical Building being the largest at 68,672-square feet. The facility, which was 95-percent leased at the time of sale, encompasses a surgery center and a range of medically diverse tenants including, Vivid Dental Greensboro, Solis Mammography, Cone Health (-/AA-/AA)1 and Duke Health (Aa3/AA-/AA-)1.

Source: Based on an FTS analysis of industry data from Real Capital Analytics and Chatham Financial

Regional Review

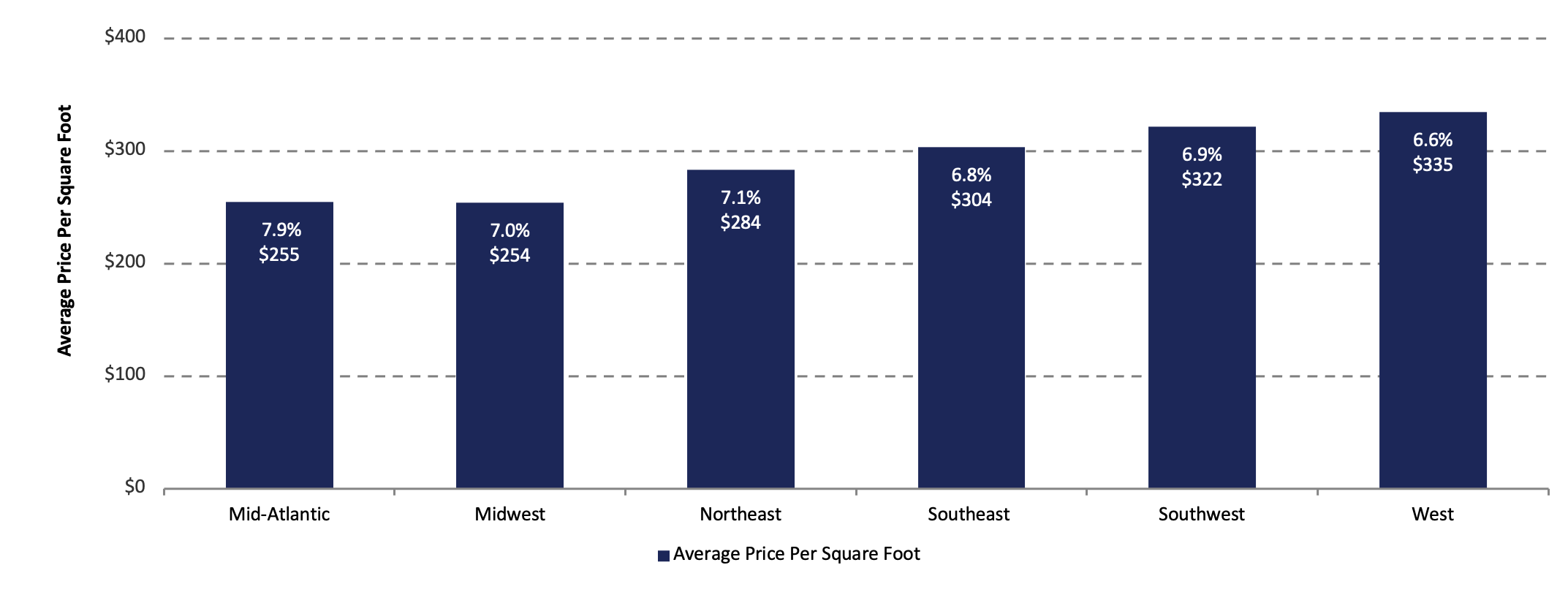

In the second quarter, the Southeast led the U.S. with $802 million in sales followed by the West with $627 million in sales. Combined, these two regions accounted for over 60-percent of the total sales volume for the quarter. The two regions also led the country in average cap rates for the quarter with the West sitting at 6.6-percent and the Southeast sitting at 6.8-percent, both unchanged from the previous quarter. The Southwest was the only other region to post a sub-seven average cap rate, while the Mid-Atlantic region experienced decreased valuation metrics with its average cap rate rising 50 basis points to 7.9-percent, or 80 basis points higher than the Midwest who has the second highest average cap rate of 7.1-percent.

Source: Based on an FTS analysis of industry data from Real Capital Analytics

Northeast Region

In May, a joint venture between Kayne Anderson Real Estate and Remedy Medical Properties acquired a 52,334-square foot medical outpatient building in Boston, MA for $36.4 million or $695/square foot. Redeveloped in 1984, the building was 100-percent occupied at the time of sale and houses tenants including Atrius Health who offers primary care, family medicine, obstetrics, gynecology and a range of surgical care services at the location.

In June, a 34,599-square foot medical outpatient building in Livingston, NJ sold to an undisclosed buyer in for $13.5 million, equating to a 7.42-percent cap rate. The 1985-vintage, three-story facility is strategically situated less than a mile from Cooperman Barnabas Medical Center and includes medical tenants such as Summit Healthcare Management and SamWell Institute for Pain Management. Services offered at the outpatient facility include treatment options for back, neck and nerve pain along with migraine treatment options.

Mid-Atlantic Region

In May, Sila Realty Trust, Inc. (NYSE: SILA) purchased the two-story, 30,000-square foot, Reading Healthcare Facility in Reading, PA for $10.5 million. The facility sits on the campus of the Tower Behavioral Health Facility, a 144-bed inpatient behavioral health hospital, just four miles from Tower Health’s 697-bed Reading Hospital. Reading Healthcare Facility serves as the outpatient treatment center for former patients of the tower behavioral health facility while also capturing referrals from Tower’s Reading Hospital. The Reading Healthcare Facility is 100-percent leased to a joint venture between Acadia Healthcare (Ba2/BB-/-)1 and Tower Health (-/CC/CCC)1.

In June, Blue Arch Capital acquired Doctors Medical Park, a 90,076-square foot, three-building outpatient clinical portfolio in Silver Springs, MD for $15.3 million or $169/square foot. The portfolio hosts a range of medical tenants including Community Radiology Associates, Fresenius Medical Care (Baa3/BBB-/BBB-)1, Capital Women’s Care and the Ladas Eye Group. Built in the 1980’s and located less than a mile from Holy Cross Hospital, Blue Arch plans to carry out a value-add business plan to update the facilities and take advantage of the asset’s strategic location in the Silver Springs market.

West Region

In April, Remedy Medical Properties acquired Orchard Park Medical center, a 75,605-square foot medical outpatient building in Westminster, CO for $30.6 million from Development Solutions Group. The two-story outpatient facility was built in 2022 and was 93-percent leased at the time of sale. Anchored by an ambulatory surgery center that’s leased to Panorama Orthopedics and Spine Center in partnership with CommonSpirit Health (A3/A-/A-)1 and United Surgical Partner International, the building includes four operating rooms and two procedure rooms while offering specialty surgical care along with imaging, spine and orthopedic services.

In May, Montecito Medical purchased a 33,351-square foot ambulatory surgery center in Las Vegas, NV for $18.5 million or $544/square foot. The single-tenant surgery center is leased to Specialty Surgery Center, an affiliate of Sunrise Health, and houses ten operating rooms. Services offered at the facilities include pain management, gastroenterology, general surgery, orthopedic surgery and ophthalmology.

In June, a joint venture between Cypress West Partners and TPG Angelo Gordon acquired a 37,000-square foot medical outpatient building in San Diego, CA for $11.6 million or $312/square foot. Located on the campus of the 173-bed Scripps Mercy Hospital Chula Vista, the asset traded for a cap rate of 6.75%, illustrating the increased value proposition of outpatient buildings located on hospital campuses. The building houses 12 medical tenants with Scripps Health (-/AA-/AA)1 as the anchor tenant.

Southwest Region

In May, a joint venture between Cypress West Partners and TPG Angelo Gordon purchased an 84,725-square foot medical outpatient facility in Scottsdale, AZ for $21.0 million. The property, McDowell Mountain Medicine, was 93.2-percent leased at the time of sale and encompasses medical tenants including, Select Physical Therapy, Ong Plastic Surgery, Arizona Digestive Health and Royal Spine Surgery.

In June, Birmingham-based healthcare real estate investment and development company, The Sanders Trust, acquired a 60,932-square foot inpatient rehabilitation facility in Tulsa, OK from Northwest Healthcare Properties for $34.2 million. The 53-bed Rehabilitation Hospital of Tulsa is operated by PAM Health and offers rehabilitative services for patients recovering from brain injuries, strokes, spinal cord injuries and complex orthopedic conditions. The Sanders Trust sold the asset to the seller in 2022 and its buyback was for less than the price they sold it to the REIT at.

Midwest Region

In May, a joint venture between Montecito Medical and AEW Capital Management acquired a two-property MOB portfolio in Wisconsin for $28.0 million. Totaling 70,000 square feet, both buildings are 100% occupied by Children’s Wisconsin, an affiliate of Medical College of Wisconsin, Inc. (Aa3/AA-/-)1, on long-term leases. The two facilities, located in Mequon, WI and Delafield, WI, offer over 25 pediatric specialties such as audiology, neurology, primary care, surgical care and behavioral health services while encompassing an on-site pharmacy and sports medicine facility.

Also in May, Midwest Equity Developers purchased a 40,194-square foot medical outpatient building in Wheaton, IL for $28.4 million or $706/square foot. Trading at a 5.9-percent cap rate, the property is occupied by Duly Health and Care who offer services at the facility including, primary care, pediatrics, neurology, OBGYN, physical therapy and more.

In June, Milwaukee-based Hammes Partners acquired a newly delivered, medical outpatient building in Reynoldsburg, OH for $22.8 million or $368/square foot. Spanning 62,000 square feet, the building will be anchored by Central Ohio Primary Care, the largest physician-owned primary care group in the county with over 350 physicians in its network. The new MOB will offer patients best-in-class primary care services and include laboratory and testing facilities.

Southeast Region

In April, Highwoods Properties sold an eight-property MOB portfolio to two separate buyers, Evergreen Medical Properties and Northwood Ravin for $79.4 million. Located in Raleigh, NC, the portfolio assets totals 338,000 square feet with a diverse tenant mix including Raleigh Eye and Face Plastic Surgery, HRC Behavioral Health & Psychiatry, Raleigh Spine and Pain Center, LifeStance Health and SME Clinic. Located in proximity to the 665-bed UNC Rex Hospital, WakeMed Raleigh Campus and Duke Regional Hospital; the portfolio was 84-percent occupied at the time of sale.

In May, Anchor Health Properties acquired a 70,000+ square foot medical outpatient building in Sarasota, FL for $31.8 million. Constructed in 2020, the asset was 100% occupied at the time of sale and leased to several medical tenants including, the Cancer Center of Sarasota-Manatee, Lakewood Ranch Medical Group Primary Care, Venas Vascular Specialists, BioSpine Institute and Fresenius Kidney Care. There are also plans at the facility to construct an ambulatory surgery center that will comprise two operating rooms and offer orthopedic, podiatry, joint replacement and spinal surgery procedures. The future surgery center will be operated by Advanced Surgery Center of Sarasota.

In June, Montecito Medical purchased a two-property outpatient surgery center portfolio in Charlotte, NC from Healthpeak Properties (NYSE: DOC) for $13.8 million. Totaling 36,287 square feet, the two adjoined buildings are 100-pecent occupied by Atrium Health (-/AA/AA)1, a leading health system in North Carolina with 40 hospitals and over 1,400 locations. The two facilities offer patients a range of medical services including oral medicine, maxillofacial surgery, sleep medicine and wound care.

To learn more about healthcare investment banking and real estate investment banking solutions, contact Philip J. Camp, Managing Director, Real Estate Investment Banking Group, at pj.camp@53.com or Matthew T. Tarpley, Managing Director, Real Estate Investment Banking Group, at matthew.tarpley@53.com.