Real Estate Investment Banking

We’re here to help:

Real estate affects every business—it’s a critical component to operating companies, such as medical buildings to healthcare providers or warehouses to industrial businesses, or as the sole focus of property developers and investors, both public and private. Fifth Third’s Real Estate Investment Banking (REIB) Group provides the expert advice and transaction-execution capabilities to help your business thrive, providing advisory and transactional services to operating companies, developers and investors across diverse markets.

With experience from boutique firms and brokerage houses to full-service investment banks, we believe that our diverse experience, asset-specific expertise and our dedication to achieving outstanding results for our clients is unmatched in the industry. Unlike brokerage firms whose compensation structure disincentivizes a team approach, we always work in teams with senior leadership to bring the best group of industry-specific professionals to every client on each transaction.

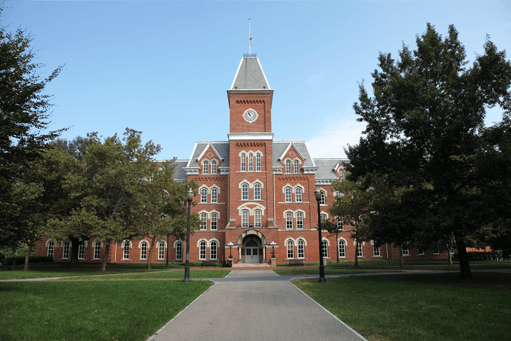

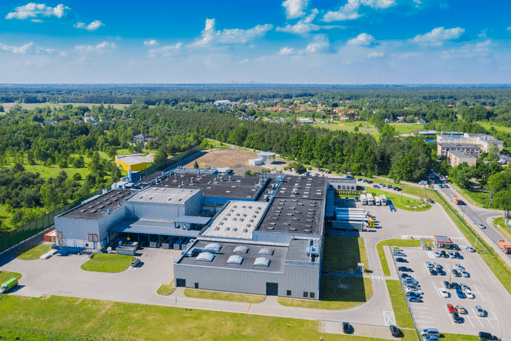

Real Estate Sectors We Serve

Our Services

Fifth Third’s real estate advisory and investment banking services include disposition and acquisition advisory, debt and equity capital raising, sale/leaseback and joint venture structuring, developer selection processes, mergers and acquisitions for real estate companies and a range of pre-transaction strategic advisory services.

We offer:

- Consultation on Value and other Pre-Transaction Advisory Services

- Real Estate Transaction Alternatives Study (RETAS)

- Disposition and Acquisition Advisory

- Debt and Equity Capital Raising

- Structured Finance Transactions

- Sale/Leaseback and Joint Venture Structuring

- Tax-Deferred Strategies

- Developer Selection Processes

- Mergers and Acquisitions for Real Estate Companies

- Other Transaction Advisory Services

Learn more:

Real Estate Leadership Team

The REIB Group spans several sub-sectors within the broader real estate industry including healthcare, higher education, industrial, retail, multifamily and hospitality, as well as other specialty asset types. Our subject matter expertise and real estate transaction experience are complemented by dedicated human and capital resources across Fifth Third, bringing the full-service capabilities of one of the nation’s leading banking platforms to our clients.

Our team of professionals have completed hundreds of transactions in nearly every state, with over $17 billion in transaction value. With over 70 years of combined experience, we are thought leaders who speak regularly at national conferences and actively serve on counsels of the nation’s largest and most important real estate professional associations such as Urban Land Institute (ULI) and the National Association of Industrial and Office Parks (NAIOP).

Select Transactions & Case Studies

Jadian Capital - Collection Center Property Company, LLC

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: M&A Advisory-Real Estate Monetization

Industry: Commercial Real Estate

ProHealth Care, Inc.

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: Real Estate Transaction Alternative Study (RETAS) and M&A Advisory-Acquisition

Industry: Healthcare Real Estate

Hicks Ventures – Fargo Rehab, LP, El Paso Rehab, LP and Louisville Rehab, LP

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: M&A Advisory-Real Estate Monetization

Industry: Healthcare Real Estate

Meridian Senior Living, LLC – AM Behavioral Health, LLC

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: M&A Advisory-Debt & Equity Raise

Industry: Healthcare Real Estate

Catalyst HRE, LLC

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: M&A Advisory-Debt Raise

Industry: Healthcare Real Estate

Summit Development, LLC

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: M&A Advisory-Real Estate Monetization

Industry: Commercial Real Estate

Nebraska Medicine

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: Developer Selection

Industry: Healthcare Real Estate

Yuma Regional Medical Center

Fifth Third Capital Markets Role: Exclusive Financial Advisor

Transaction Type: M&A Advisory-Real Estate Monetization

Industry: Healthcare Real Estate

*Executed by Fifth Third Securities, Inc.

**Executed by H2C Securities Inc.

We’re here to help: