Creating Liquidity for Healthcare Providers Through Real Estate

Our real estate investment banking team discusses how healthcare providers can create liquidity through real estate.

Healthcare providers’ operating margins and balance sheets remain under pressure as the need to enhance patient care, expand services and invest for the long-term is vital to stay competitive.

To generate additional cash on balance sheets, forward-thinking health systems are utilizing existing real estate portfolios to create and explore liquidity options. These health systems are repurposing or monetizing existing real estate, implementing innovative joint-ventures, and utilizing third-party capital to overcome legacy constraints and deliver new facilities faster.

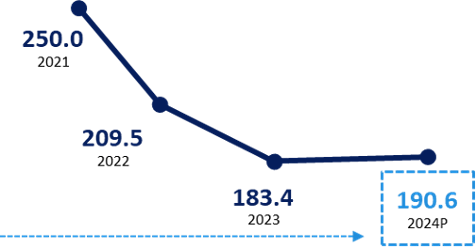

Not-for-profit health systems have significantly less cash on hand today than previous years. According to the S&P Global Ratings 2024 outlook for nonprofit hospitals, the median days of cash on hand was 183 days in 2023, down 25% from 250 days in 2021.1

Median days of cash on hand for nonprofit hospitals.1, 2

Optimizing real estate portfolios

Healthcare providers have several options available to optimize real estate portfolios and create extra liquidity that can be utilized to invest, develop new assets and align portfolios with the newest delivery methods.

Depending on the goals of the health system, multiple options are available to achieve desired objectives:

Repurposing or monetizing real estate

More than 20 not-for-profit health systems executed some form of real estate monetization in 2023, according to a review of health system real estate activity3. Examples of these opportunities are outlined below.

Monetization opportunities:

- Sale/leaseback

- Sale/partial leaseback

- Partial interest sale/leaseback

- Asset-level/re-financing

- Non-core/non-utilized asset monetization

- Charitable foundation lease

Key questions to ask when considering monetization options:

Cash proceeds

- How much value does the system want to extract?

- What will the cash generated through a transaction be used for?

Assets

- Which assets should be included in a transaction?

- How do you choose those assets?

Lease accounting

- Can a transaction be structured to accomplish the desired lease accounting treatment?

Financial statement

- How does the transaction effect the income statement and balance sheet?

Real estate taxes

- Does a transaction trigger real estate taxation?

- Will the services at the asset generate a healthy return with rent payment added to expenses?

Control

- Are any control provisions required, such as the ability to acquire the asset back should it be monetized?

- How do you accomplish key control provisions as part of a transaction?

Management and ongoing relationship

- Does the system want to maintain day-to-day property management?

- Does the system want to offload future asset-level capital expenditures to a third-party?

Innovative joint ventures

To understand the potential savings that can be achieved through a joint venture, it is imperative to have a clear picture of the breadth of a health system’s real estate portfolio.

Key factors to consider:

- Rental rate in comparison to market rental rates

- Control provisions within underlying leases or ground leases

- Current versus future utilization

- Opportunity cost of cash

Transaction opportunities:

- Consolidate into multi-specialty buildings

- Restructure lease agreements

- Acquire leased facilities

Partnering with third parties

Health systems can offload some capital responsibility to the developer by partnering with third parties. This ensures the lowest budget to construct and increases speed-to-market. The increase in construction cost that has taken place over the last two years has increased the desire for health systems to leverage third-party developer expertise to deliver projects in a more-affordable manner.

As a result of changes in interest rates, health systems are benefiting from record-low spreads between their cost of capital and the developer’s financing cost for a build-to-suit project. With minimal difference between the two, the value proposition of partnering with a developer is further amplified.

Partnership opportunities:

- Self-finance and develop

- Third-party developer capitalized

- Joint-ventured development

- Ownership-reversion build-to-suit

Infrastructure, efficiency and central utility plant investment

The rationale for evaluating a system’s infrastructure and central utility plant is driven by several factors, including the capital intensiveness to either upgrade or replace infrastructure and the resilience and reliability of existing systems. It’s also important to consider conformance to clean-energy initiatives and the long-term demand and utilization for utilities. Additional factors to evaluate include the reduction in operating expenses and potential for an upfront cash infusion. Assessing the form of energy utilized to power assets and any future energy needs is also key to these types of transactions.

Infrastructure opportunities:

- Energy utilization and condition review

- Self-finance and redevelop

- Utility plant monetization and outsourcing

- Public-private partnership

Implementation and outcomes

There is no one-size-fits-all approach to optimizing a real estate portfolio. To ensure an optimal outcome, it’s essential to review the full portfolio, including both owned and leased properties or the proposed development. It’s also important to account for market-level considerations and align the real estate strategy with the broader health system’s strategy.

Potential outcomes:

- Cost savings for new facilities

- Speed-to-market

- Resiliency of current energy infrastructure

- Balance sheet benefits

- Risk transfer

Providing a full-picture approach

Fifth Third’s real estate transaction alternatives study (RETAS) is designed to provide an organization with a full-picture approach by analyzing all potential monetization options to find the optimal solution that positions the health system to meet its overall goals and objectives. The RETAS addresses key considerations at the outset of the study, which ultimately allows the selected transaction to be executed in a timely manner, at maximum value, while maintaining key control provisions that are important to the system.

Real Estate Investment Banking Group

For more than 25 years, the real estate investment banking professionals at Fifth Third Corporate & Investment Banking have successfully served as advisors on real estate transactions in excess of $17 billion nationwide.

For additional information, contact Matthew Tarpley, Managing Director, Healthcare Real Estate Investment Banking, at Matthew.Tarpley@53.com