Fifth Third Welcome Center

Now that you’ve opened your account, it’s time to take advantage of all your banking benefits!

Start with these five steps.

1

Set Up Online Banking

2

Download the Mobile App

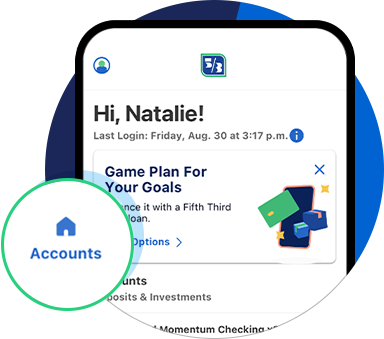

Securely manage your finances anytime, anywhere. View accounts, balances, detailed transactions, send and receive money, access 24/7 messaging, and more! Our Fifth Third Momentum® Checking customers can head directly to the app to set up their accounts (or keep reading for next steps).

3

Add Money to Your Account

There are several ways to add money to your account, including:

- Transferring money from another bank or Fifth Third account.

- Setting up direct deposit. (It’s faster in our app! And our Fifth Third Momentum® Checking customers can get their paychecks up to two days early with Early Pay once direct deposit is set up.1)

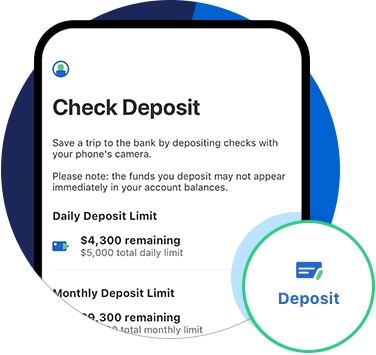

- Making a mobile, ATM or branch deposit.

Please note: Fifth Third Momentum Checking and Preferred Checking must be funded within 90 days of account opening; other consumer checking and savings accounts must be funded within 45 days of account opening. If account is not funded within specified timeframe, the account may be closed.

Looking for your new account number? Here’s how to find it.

4

Set Up Alerts and Notifications

5

Pay Bills Online

Plus, as a new customer, you’ll pay no overdraft fees for the first 90 days.4

This is banking a Fifth Third better.®